Sale Price: $0.00

Profit Amount: $0.00

Margin Percentage: 0%

Profit margin calculator is not just a set of numbers, it’s a strategic tool for businesses seeking clarity in the often complex realm of selling online.

So weather you have a an online store, a dropshipping shop on Amazon, or a physical storefront, this tool can assist you in many ways.

Let’s dive into what a profit margin entails and how a profit margin calculator can become your trusted companion in the pursuit of business success.

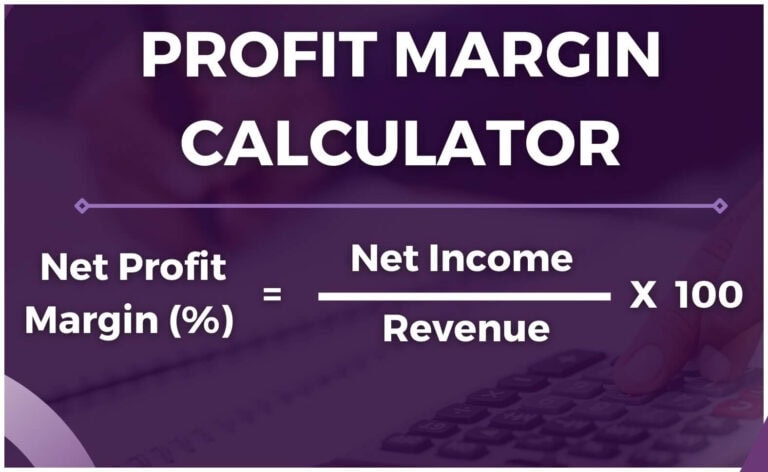

A Profit margin is the percentage of revenue that remains as profit after accounting for all costs associated with producing and selling goods or services. It’s a fundamental metric used to assess the profitability of a selling goods.

A profit margin calculator, calculates the profitability of your product or service and help you determine your sale price. Modalyst’s calculator computes the profits margin by factoring in costs, allowing you to make informed decisions and optimize pricing strategies for maximum financial gain.

It is calculated by dividing the net profit by total revenue, then multiplying by 100 to express it as a percentage.

[(Net Profit) ÷ (Total Revenue)] x 100 = Profit Margin %

(for additional reading about the formula click here)

Here’s a step-by-step guide to harnessing the power of this essential tool:

Adjust prices if necessary: If the margin is too low, consider adjusting the selling price or negotiating a lower cost with your supplier, then recalculate

Sale Price: $0.00

Profit Amount: $0.00

Margin Percentage: 0%

In the fast-paced world of business, where every decision matters, using a Profit Margin Calculator becomes a strategic move for several compelling reasons:

Now, let’s uncover the features that make a Profit Margin Calculator an indispensable tool for businesses:

While a Profit Margin Calculator is a valuable tool, it’s essential to be aware of common pitfalls that businesses may encounter. Here are some mistakes to steer clear of:

Overhead costs, including rent, utilities, and salaries, are easy to overlook. Ensure all relevant costs are factored in for an accurate representation of your profit margins.

Business landscapes change overtime, so failing to regularly update your calculator with current figures may lead to outdated insights. Stay proactive by keeping your data current.

Don’t cut corners on costs. Ensure all expenses, including hidden or variable costs, are accounted for. This ensures a comprehensive understanding of your profit margins.

Benchmarking against industry standards is crucial. Ignoring these benchmarks may result in setting unrealistic profit margin goals or missing opportunities for improvement.

Some businesses experience seasonal fluctuations, therefore, failing to account for seasonality can lead to inaccurate assessments of profitability.

High profit margins might seem attractive, but they don’t tell the whole story. Evaluate other factors, such as sales volume, to ensure overall business health.

Ignoring your competitors’ pricing strategies can be a costly mistake. It is vital to stay informed about your industry trends and competitor pricing in order to remain competitive.

Customer satisfaction impacts your business, and ignoring feedback and not aligning your pricing with perceived value, can affect both profit margins and customer loyalty.

Let’s explore how businesses have leveraged Profit Margin Calculators to achieve success:

A small e-commerce business used a Profit Margin Calculator to analyze their pricing structure. By adjusting prices based on calculated profit margins, they experienced a 20% increase in overall revenue within six months.

A tech startup used a Profit Margin Calculator from the early stages. It guided their pricing strategy, helping them secure funding by showcasing a clear understanding of their financial health.

A dropshipping business integrated a Profit Margin Calculator into their daily operations. It allowed them to quickly assess the profitability of new product lines and make data-driven decisions, resulting in increased profit margins.

These real-life success stories underscore the versatility and impact of incorporating a Profit Margin Calculator into your business strategies. As we proceed, we’ll delve into additional insights and practical applications to ensure businesses harness the full potential of this indispensable tool.

Calculating profit margins provides a clear picture of your business’s financial health. It helps in making informed decisions, setting prices, and optimizing costs for sustainable growth.

Regular updates are crucial, especially in dynamic industries. Aim for monthly reviews, but consider more frequent updates during significant business changes or market shifts.

Absolutely. A Profit Margin Calculator is a valuable tool for optimizing pricing strategies. It helps determine competitive yet profitable prices that contribute to your business growth.

Profit margins vary across industries. While some industries operate with higher margins, others may have slimmer margins due to factors like competition and production costs. Understanding industry benchmarks is key.

Yes, one of its key benefits is identifying areas for cost optimization. By breaking down costs, the calculator helps businesses pinpoint inefficiencies and optimize expenses for better overall profitability.

Seasonal fluctuations can affect revenue and costs differently throughout the year. A Profit Margin Calculator helps account for these variations, providing insights into the impact of seasonality on profitability.

While a higher profit margin is generally positive, it’s not the sole indicator of business success. Consider other factors like sales volume and market share for a comprehensive evaluation